Quick guide: 2025 U.S. tax changes for beauty and wellness businesses

Explore what you can expect from new tax laws at a glance.

Most Popular

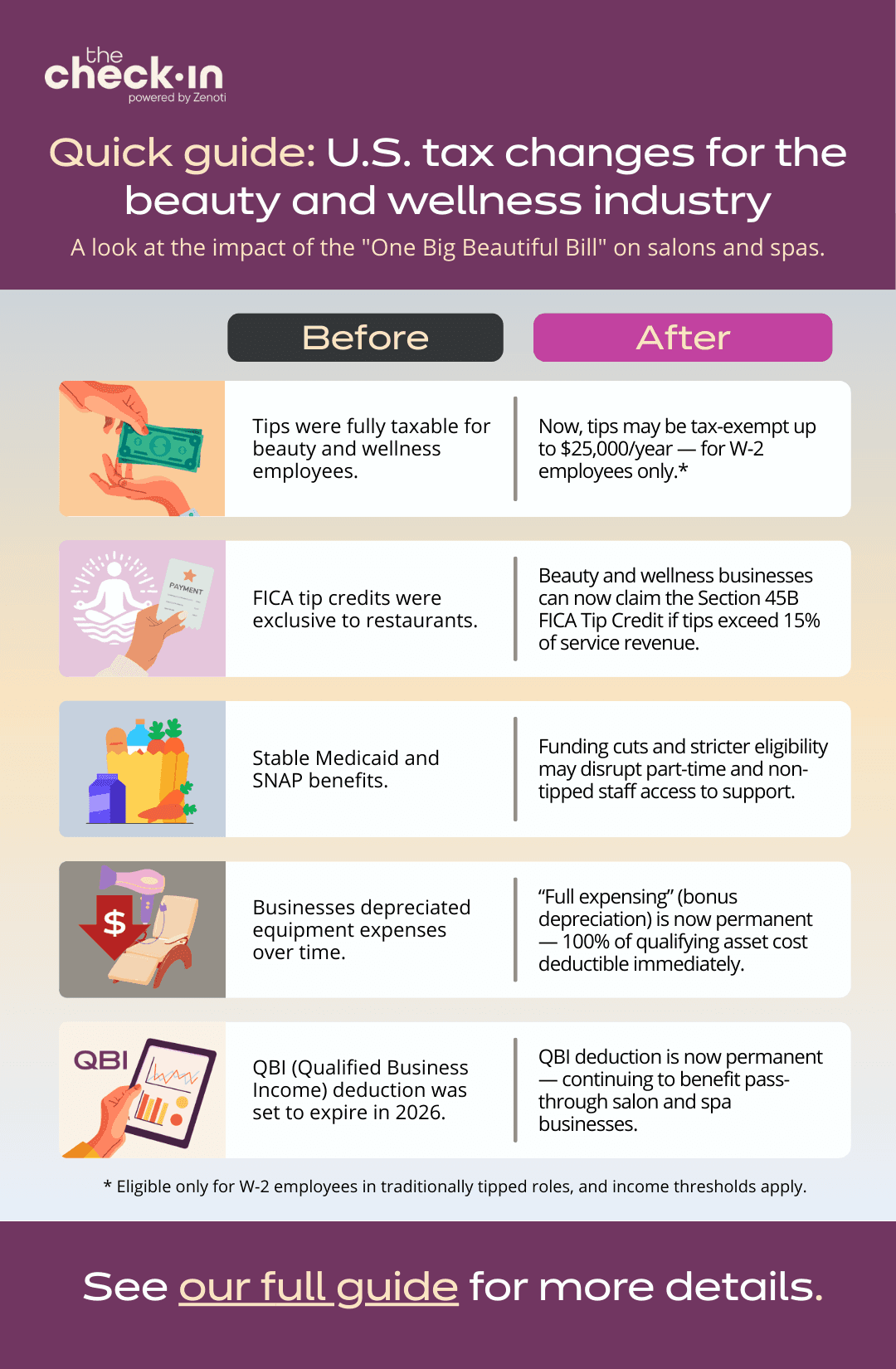

Big tax changes are here for beauty and wellness businesses, including salons, spas, barbershops, and medspas. From new tipping rules to better tax breaks for equipment and income, the updates can make things easier (and a bit more rewarding) for both owners and full-time employees. Here’s a quick side-by-side look at what to expect from these new tax changes:

While the bill presents a wealth of positive changes for beauty and wellness businesses, it also includes cuts to SNAP benefits, Medicaid, and other welfare programs, which may negatively impact clients and part-time staff. Businesses and employees can consult a tax professional to fully leverage these benefits and explore solutions to mitigate the potential negative side effects.

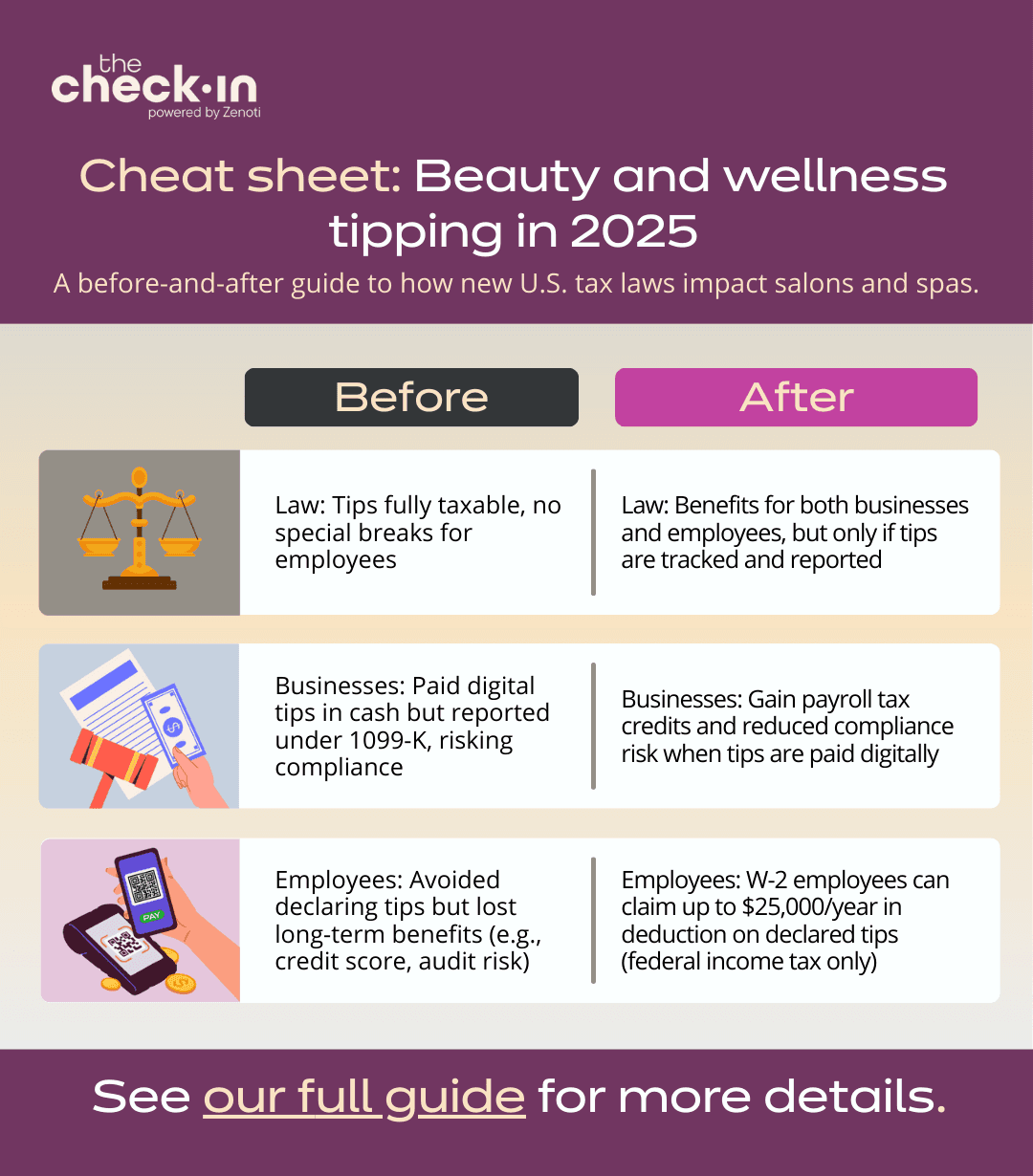

Cheat sheet: The tipping changes coming to businesses

Tip reporting used to be a gray area — and let’s be honest, kind of a hassle. But new rules in 2025 bring some real perks if you’re doing things by the book. Think tax breaks for employees, credits for businesses, and fewer compliance headaches when paying tips digitally. Let’s explore a quick breakdown of what’s different and why it matters:

You can read our full guide to new U.S. tax changes for beauty and wellness businesses, or explore other industry insights you may need to grow your brand.

Book your bi-weekly check-in for industry tips, trends, and insights to grow your brand

People Also Read

Your standing appointment for business growth — delivered straight to your inbox

Get the latest industry tips, trends, and insights to grow your brand.